Vietnam

Fund profile

TCM Vietnam High Dividend Equity is a high dividend equity fund. At least half of the fund capital will be invested in listed shares on the exchanges of Ho Chi Minh City and Hanoi. At the most 20% of the fund can be invested in the Vietnamese OTC market. This depends on the liquidity of this market. The funds investment policy will be aimed at achieving capital growth. In principle, the fund does not pay a dividend. Dividends received are reinvested within the fund.

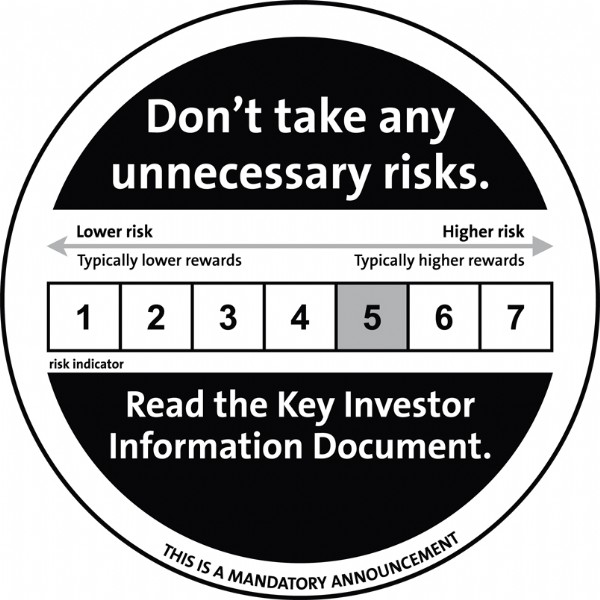

The risk profile is high, due to investments being channelled into frontier markets in Vietnam. The relationship between global financial markets and the Vietnamese markets is low, because the latter are less sensitive to international developments.

To achieve its objective, the Fund invests 95% to 100% of its total assets through TCM Investment Funds Luxembourg in units of TCM Vietnam High Dividend Equity (Lux). The Fund qualifies as feeder-structure.

Sustainability

TCM has entered into an agreement with Clarity AI for the screening of the portfolios of the TCM equity funds on ESG criteria (UN Global Compact and Controversial Weapons).

Downloads

Disclaimer

No rights may be derived from this publication. You are referred to the prospectus and Key Investor Information Document for the fund's terms and conditions. These documents may be obtained from the website or the address mentioned below. The manager of the fund has obtained a licence for this fund from the Netherlands Authority for the Financial Markets in accordance with the provisions of the Financial Supervision.