Sharp drop in oil price also has winners

Last Monday the oil price (Brent) fell by 24.1% per barrel. Oil prices have been under pressure since the start of 2020. This pressure was caused by reduced oil demand due to the spread of the corona virus. To stabilize the oil price, Saudi Arabia's proposal was to limit oil production.

Meetings between the OPEC and Russia, which is one of the largest oil producers and not a member of the OPEC, ended negative. To change Russia's minds, the Saudis changed their tactics and turned oil production higher. As a result, the oil price fell to its lowest level since February 2016.

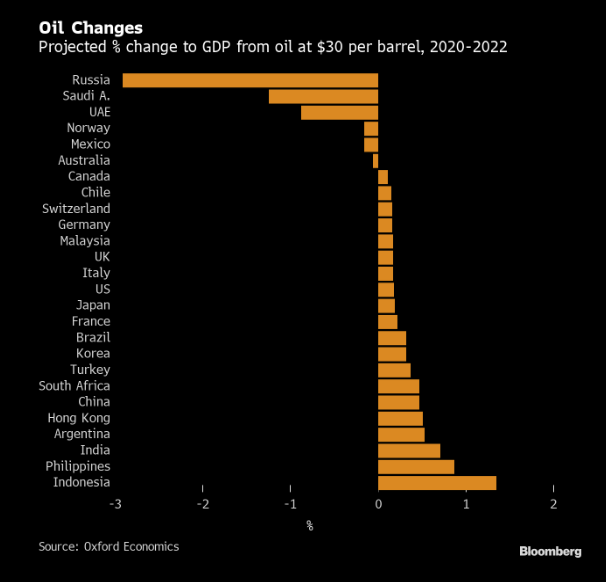

A low oil price is an unfavorable development for many countries. Oil producing and exporting countries are particularly affected by this, because there is a high dependency on oil revenues. On the other hand, there are many countries that import oil to keep the economy going. Many of these countries have the status of emerging countries. Is a low oil price favorable or unfavorable for GDP development for these countries? A Bloomberg publication shows that Indonesia, the Philippines and India in particular benefit from low oil prices, unlike the culprits in Saudi Arabia and Russia.

The study does not show how the African continent responds to a low oil price. For OPEC countries Algeria and Nigeria, the low oil price will not have a positive effect on GDP, but the vast majority of the continent depends on the oil producing countries and imports one of the main raw materials for the economy at a much cheaper rate.

A good example is Kenya. A low oil price will have a substantial positive effect on the trade balance and will reduce imported inflation. In 2019, imports of oil products were $ 3.31 billion US dollars at an average price of $ 66.5 US dollars per barrel. Now that the oil price has halved, this will bring significant savings to the country. In Kenya, diesel is used not only for transportation and agricultural machinery, but also for power generation. The oil price is therefore an important factor in inflation.

Joure, 16 March 2020